01 Jun 2015 Amended by. Section 4061 Taxation International Taxation Life Insurance and Remedial Matters Act 2009 2009 No 34.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Taxation Business Tax Measures.

. BE it enacted by Parliament in the Sixty-eighth Year of the Republic of India as follows CHAPTER I. Persons on whom tax is to be collected. Exceptions to section 530.

Short title extent and commencement. CHAPTER II BASIS OF CHARGE 4. Income tax treated as paid and reliefs.

Taxation Consequential Rate Alignment and Remedial Matters Act 2009 2009 No 63. Apportionment of income between spouses governed by Portuguese Civil Code. THE CENTRAL GOODS AND SERVICES TAX ACT 2017 NO.

11- You will have to cough up 100 to 300 per cent of tax due as penalty for concealing income WEF. 1 THE INCOME-TAX ACT 1961 _____ ARRANGEMENT OF SECTIONS _____ CHAPTER I PRELIMINARY SECTIONS 1. Act 39 of 2017.

Regulations providing for relief in other cases where foreign tax chargeable. General provisions as to valuation of benefits. Income Tax Act 1947.

10- Income Tax Returns under Section 1395 of Income Tax Act 1961 can be revised when filed pursuant to notice under Section 148 as it is provided us 148 that for such return all the provisions of section 139 shall apply. Scope of total income. 12 OF 2017 12th April 2017 An Act to make a provision for levy and collection of tax on intra-State supply of goods or services or both by the Central Government and for matters connected therewith or incidental thereto.

2017-18 the penalty shall be 50. Meaning of comparable EEA tax charge 534. Income tax treated as paid etc.

Current version as at 07 Jul 2022. Provided that the prescribed income-tax authority or the person authorised by such authority referred to in sub-section 3 shall within the prescribed time after the end of each financial year beginning on or after the 1st day of April 2008 prepare and deliver to the buyer referred to in sub-section 1 or as the case may be to the licensee or lessee referred to in sub. Exceptions to section 528.

Immigration Act 2009 2009 No 51. Accident Compensation Amendment Act 2010 2010 No 1. Personal Income Tax Act CHAPTER P8 PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1.

Business or trade only. 29 May 2015 Amended by Act 2 of 2016. Relief for policies and contracts with European Economic Area insurers.

Valuation as to living accommodation.

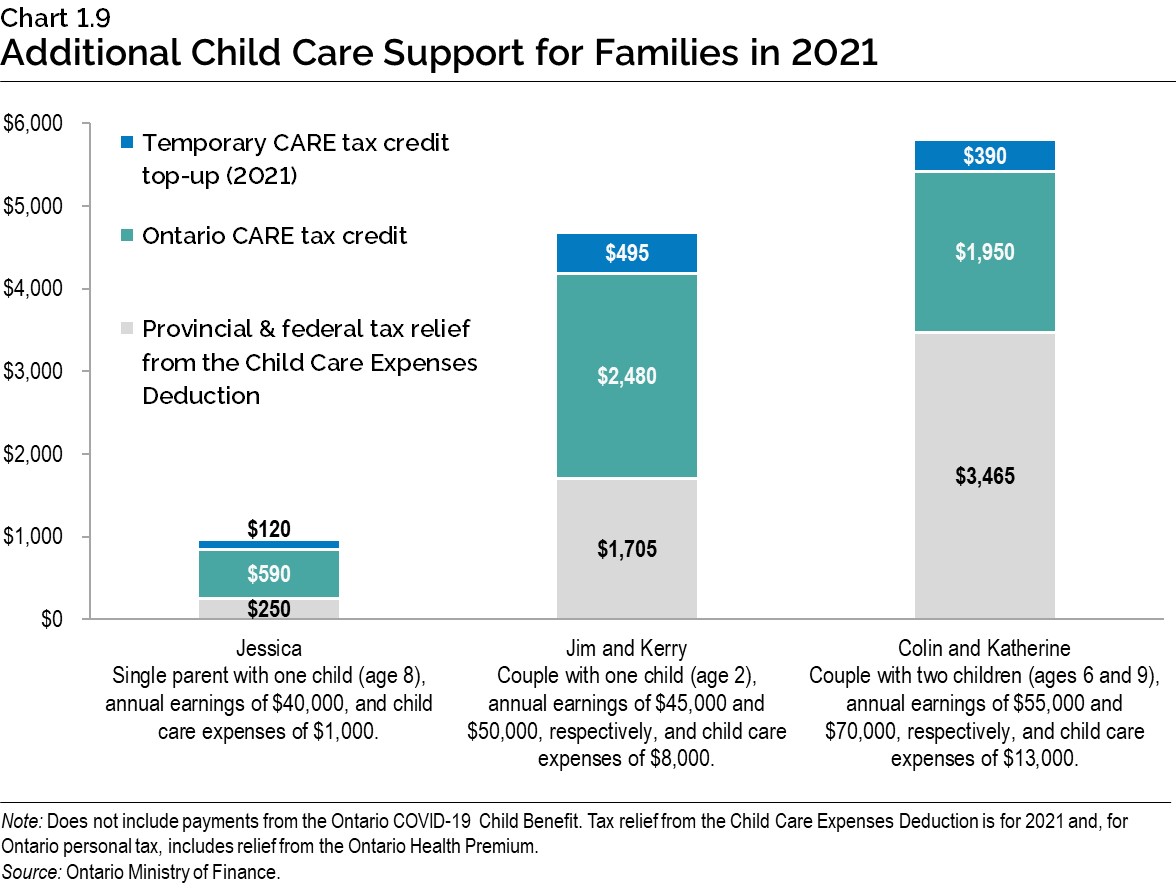

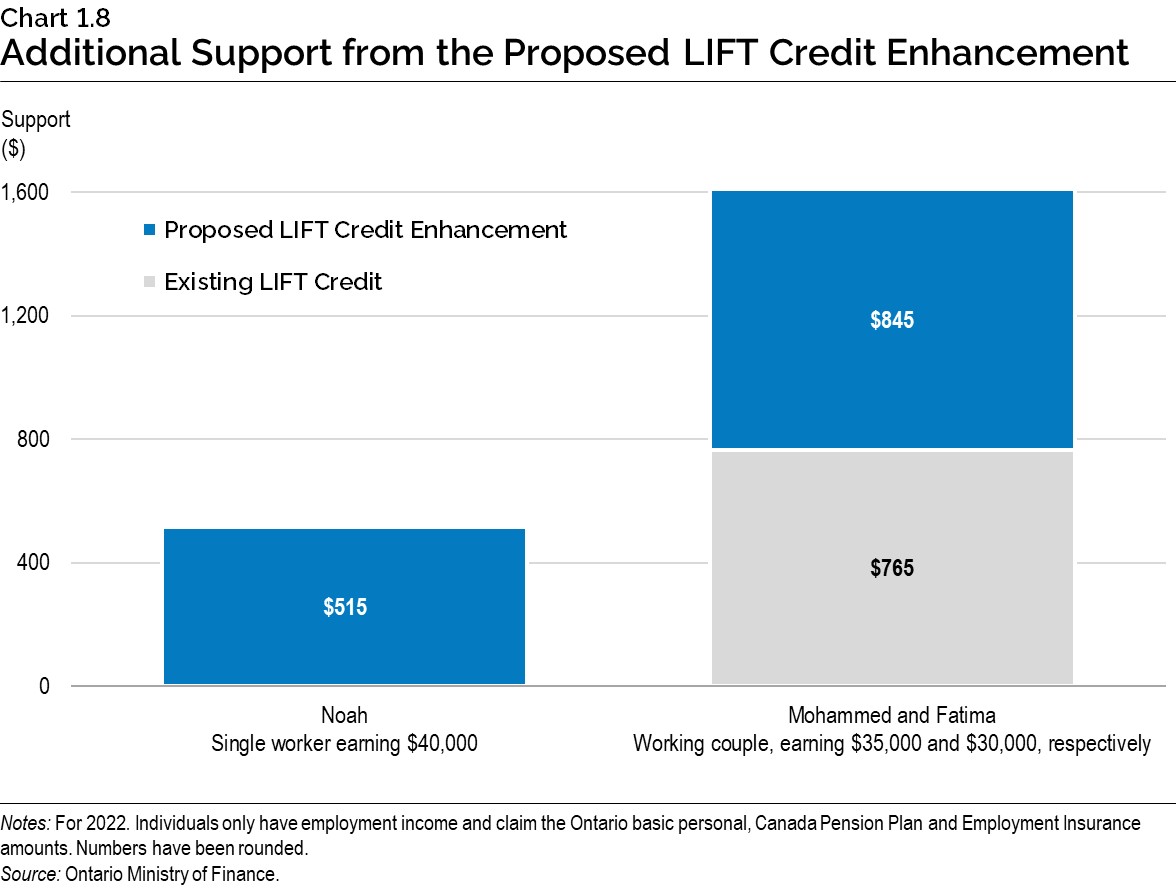

2022 Ontario Budget Chapter 1d

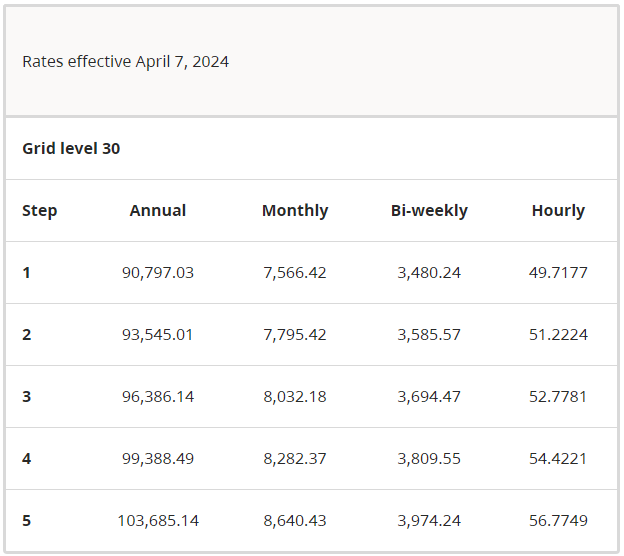

Administrative Officer Province Of British Columbia

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

2022 Ontario Budget Chapter 1d

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Annex 6 Tax Measures Supplementary Information Budget 2021

International Corporate Taxation What Reforms What Impact Cairn International Edition

Measuring What Matters Toward A Quality Of Life Strategy For Canada Canada Ca

Fill Free Fillable Government Of Canada Pdf Forms

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

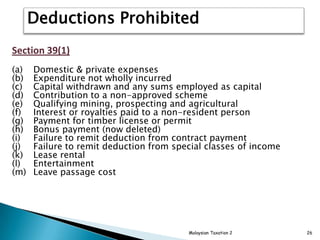

Chapter 5 Corporate Tax Stds 2

Annex 6 Tax Measures Supplementary Information Budget 2021

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)